Jumbo loans: Requirements and qualifications

Jumbo loans are mortgage loans that have a higher-than-normal balance. Here's what you need to know about securing this type of financing in 2021.

Read more

Jumbo loans are mortgage loans that have a higher-than-normal balance. Here's what you need to know about securing this type of financing in 2021.

Read more

Looking to buy a property that makes money for you? Learn the minimum qualification requirements to get a mortgage pre approval for an investment property.

Read more

Discover how loan subordination lets you refinance while keeping a second mortgage: What it is, how it works, key steps, and why it’s important.

Read more

Lenders will evaluate credit scores differently starting September 18th, and homeowners may be in a position to save even more on their next refinance.

Read more

For one local man, being able to live on the river is much more than a perk—it’s personal.

Read more

Learn about how much money you can borrow with an FHA loan.

Read more

Considering an out-of-state move? Don’t overlook these cities with lower costs of living and affordable homebuying options.

Read more

Learn what to expect during the mortgage loan closing process, including key steps, timelines, and tips to ensure a smooth and successful home purchase.

Read more

Low-income homeowners who were previously denied a mortgage refinance may now qualify through RefiNow™. You may save up to $3k/yr by lowering your monthly costs.

Read more

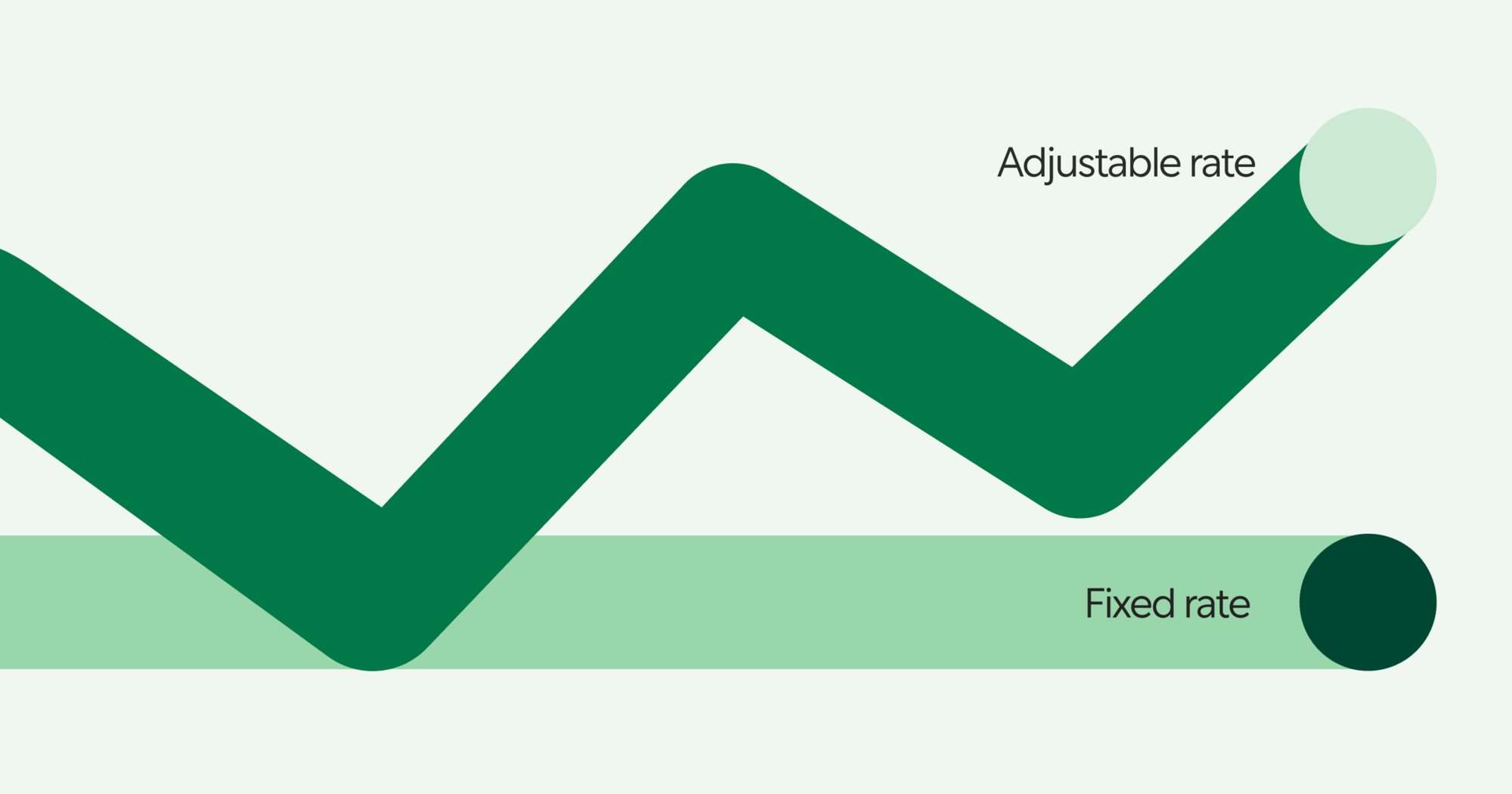

Trying to decide between a fixed-rate mortgage and an adjustable-rate mortgage? Here’s the difference, and how to figure out which home loan is right for you.

Read more

Mortgage News: While a recent dip in rates may provide homeowners savings, the truth is, shifts in the market shouldn’t determine when it’s time to refinance.

Read more

Thinking about buying a second home? Learn key rules, lender requirements, and expert tips to qualify, secure financing, and buy your dream second home.

Read more

The real estate market is showing no signs of slowing, as homebuyers begin to feel the fatigue of multiple-offer scenarios and all-out bidding wars.

Read more

If you’re refinancing a mortgage, locking your interest rate now can help you save money in the long run. Here’s how to decide if you should lock your rate today.

Read more

Refinancing may help you save money and give you access to your home equity. Here are the pros and cons of refinancing, and scenarios when it makes sense.

Read more

Consolidate high-interest debt with a cash-out refinance from Better Mortgage.

Read more

Many people are involved in the process of buying a home. You can expect to talk to everyone from a real estate agent to a loan consultant, and more.

Read more

If you’re applying for a mortgage or refinancing, you’ll need to “lock” your rate during the loan process. Here’s a breakdown of what exactly that means.

Read more

Learn how to navigate buying a new construction home—from the home loan process, through assembling your team, and how you can avoid predatory lenders.

Read more

Amidst a record drop in consumer confidence, and low returns on traditionally safe investments, the Fed moves to make more credit available to consumers.

Read more

Need something else? You can find more info in our FAQ